Understanding the Mortgage Process for Lenders

The mortgage process can be daunting, not just for borrowers but also for lenders who play an essential role in helping individuals navigate their journey towards homeownership. Understanding the intricacies of the mortgage process is vital for lenders to facilitate smoother transactions and provide ideal solutions for their clients. This guide will delve into the mortgage process from a lender’s perspective, focusing on each key stage and the significant role lenders play in the overall experience. For a comprehensive understanding of this essential topic, refer to the mortgage process for lenders.

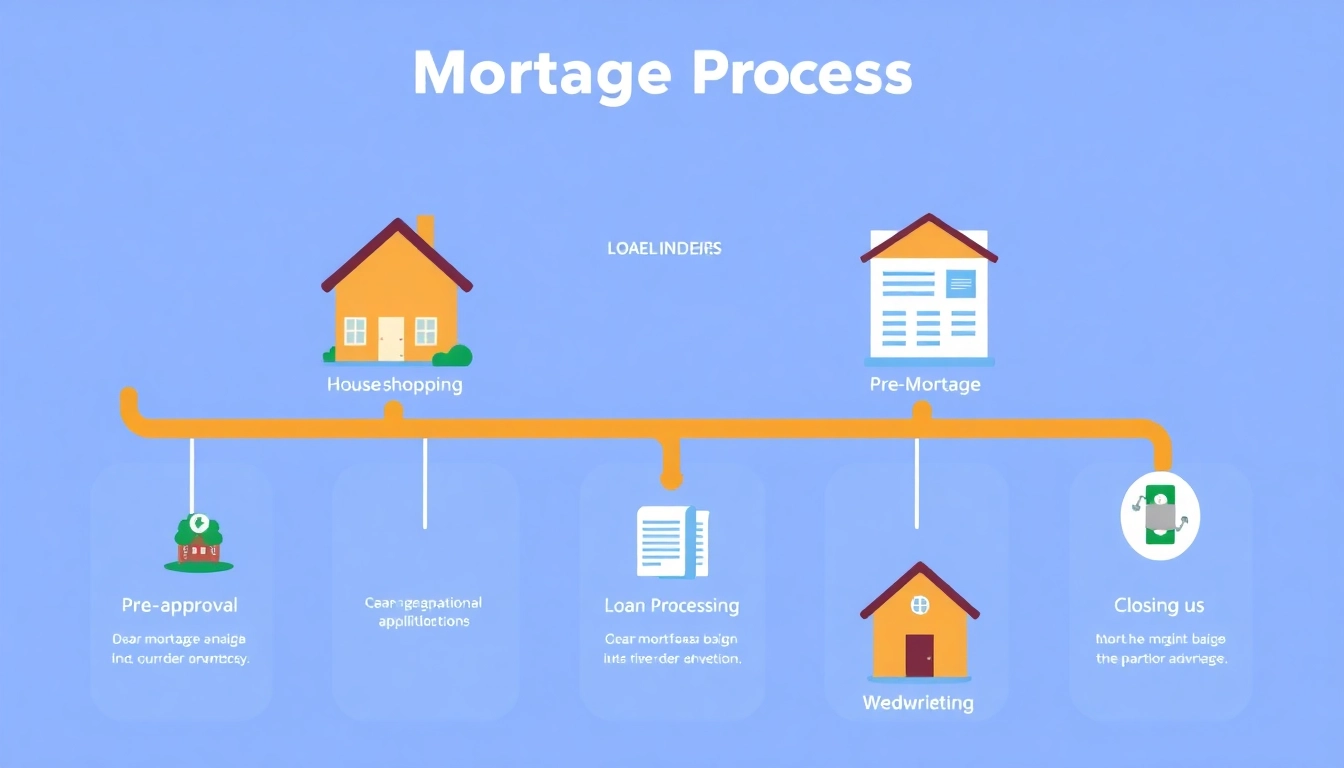

Overview of Key Stages

The mortgage process comprises several critical stages, each presenting unique challenges and opportunities for lenders. Typically, this includes:

- Pre-Approval

- Mortgage Application

- Loan Processing

- Underwriting

- Closing

Each of these stages requires meticulous attention to detail and effective communication between the lender and borrower. Often, the process can be protracted, reflecting factors like borrower preparedness, lender responsiveness, and external economic conditions.

The Role of Lenders in the Process

Lenders serve a crucial function in the mortgage process, acting as the conduits between the borrower and the funds necessary for home purchasing. Their responsibilities include:

- Evaluating borrower applications

- Assessing creditworthiness and risk profiles

- Providing guidance throughout the process

- Ensuring compliance with regulatory requirements

By establishing trust and open communication, lenders can help borrowers feel more comfortable during a process that is often fraught with anxiety and uncertainty.

Common Challenges Faced

The mortgage landscape is peppered with challenges that lenders must navigate skillfully to ensure loan approval and closing timelines remain on track. Common hurdles include:

- Document collection issues

- Appraisal discrepancies

- Credit evaluation complexities

- Regulatory compliance changes

Understanding these challenges will help lenders to pre-emptively address issues that can derail mortgage processing, thereby enhancing borrower satisfaction and operational efficiencies.

Step 1: Pre-Approval and Its Importance

Gathering Necessary Documents

The pre-approval process sets the stage for a successful mortgage journey. Lenders typically require a range of documents from borrowers, including:

- Recent pay stubs

- Bank statements

- Tax returns

- Proof of any additional income

By gathering this documentation early, lenders can expedite the pre-approval process, providing borrowers with a clear understanding of their purchasing power.

Assessing Borrower Eligibility

Once lenders receive the required documentation, they evaluate borrower eligibility based on several criteria:

- Credit score

- Debt-to-income ratio

- Employment history

- Down payment capabilities

This assessment is pivotal because it shapes the loan terms and interest rates offered to the borrower. A thorough understanding of the borrower’s financial health allows lenders to make informed decisions regarding pre-approval.

Timeline and Expectations

The timeline for pre-approval can vary, typically lasting from a few days to a couple of weeks. Clear communication with borrowers is essential. Setting expectations early can help mitigate concerns and confusion as borrowers progress through the mortgage process.

Step 2: The Mortgage Application Procedure

Completing the Application Form

Once pre-approved, borrowers will move forward with a complete mortgage application. Lenders must guide borrowers in filling out the application accurately to avoid processing delays. The application typically includes:

- Personal identification information

- Loan specifics (amount, type, purpose)

- Borrower’s financial history

Submitting Supporting Documents

In addition to completing the application form, borrowers are often asked to submit additional supporting documents. It is here that lenders can streamline the process by providing clear lists of required documents, including:

- Proof of insurance

- Asset statements

- Employment verification

Communication with Borrowers

Effective communication during the application phase is critical. Regular updates can alleviate borrower anxiety and foster a sense of partnership. Utilizing technology for real-time updates can significantly enhance the borrower experience.

Step 3: Processing and Underwriting

Loan Processing Insights

The loan processing stage involves a thorough review of the loan application and all supporting documents. Lenders can enhance the efficiency of this stage by:

- Implementing automated systems for document management

- Training staff in common discrepancies to look out for

- Establishing clear benchmarks and performance metrics

Understanding Underwriting Criteria

Underwriting is where lenders assess the risks associated with a loan, ultimately seeing if the borrower can repay. Key criteria that underwriters look for include:

- Creditworthiness

- Property appraisal value

- Market conditions

Common Issues During Underwriting

The underwriting phase can be fraught with delays and complications. Common issues include:

- Insufficient documentation

- Appraisal discrepancies

- Rapid changes in borrower financial circumstances

Lenders should proactively address these issues by advising borrowers of potential pitfalls and fostering transparency during the underwriting process.

Step 4: Closing the Mortgage Loan

Finalizing the Loan Agreement

The closing stage is the culmination of the mortgage process. Here, agreements are finalized, and all necessary signatures are obtained. This is a complex stage, typically requiring the coordination of several parties, including:

- Title companies

- Real estate agents

- Lawyers (if necessary)

Essential Documentation for Closing

Essential documents that need to be prepared ahead of closing include:

- Closing disclosure

- Mortgage note

- Deed of trust

Having all documentation organized and readily available can expedite the closing process and reduce potential issues.

Post-Closing Responsibilities

After closing, lenders have several ongoing responsibilities, including ensuring that the loan is serviced correctly and responding to any borrower inquiries regarding repayment or servicing. Proactive handling of post-closing matters can lead to stronger borrower relationships and increased opportunities for future business.

Conclusion

The mortgage process for lenders is multifaceted and, at times, complex. However, by understanding each step thoroughly, implementing organized procedures, and maintaining open lines of communication with borrowers, lenders can improve the experience for all parties involved. Addressing challenges head-on and fostering trust and transparency throughout the journey is fundamental to creating successful mortgage transactions.